Financial KPIs: Your Path to Data-Driven Decisions

The Financial KPIs That Actually Drive Business Growth and Every Business Leader Should Monitor

Key performance indicators (or KPIs) are essential tools for understanding and improving your company’s financial health. In business (especially if it’s a fast-paced environment), knowing which metrics to track, as well as how to interpret them, may mean the difference between smart, strategic decision-making and missed growth opportunities. For founders and executives managing small businesses, which usually have tight budgets and limited resources, it can be critical to set them up in order for the business to succeed. A study about the impact of KPIs on operational efficiency and competitive advantage in trading enterprises even shows that setting well-managed KPIs significantly contributes to a business’s ability to outperform competitors.

Now that we know how much of a financial impact setting key performance indicators can have, what’s the most common issue? Well, for one, many small businesses either track KPIs manually or not at all. This means they miss out on essential insights that can drive growth and efficiency.

Understanding the Basics: What Are Financial KPIs?

In short, KPIs are measurable values that show how well your business is doing, a financial analysis, basically. Think of them as the vital signs of your business, like a strong or weak pulse.

They help you answer questions like:

- Are we making money?

- Are we spending too much?

- How long can we keep running at this pace?

For business leaders, tracking the right KPIs is not a mere accounting task. Even the smallest decision can have a big impact, so those insights aren’t just nice-to-have. They’re essential. Without tracking the right financial metrics, it’s easy to lose sight of what actually drives growth and profitability. That’s why setting clear financial KPIs isn’t just a task for your accountant. It’s a strategic move for any founder, operator, or team that wants to stay in control of their financial performance.

Firstly, let’s dive deeper into the financial metrics that every small business leader should actively monitor. These numbers can give you more clarity and make all the difference in understanding your company’s health and spotting opportunities for efficiency and growth.

Key Financial Metrics Every Small Business Should Monitor

Now that we’ve covered why financial KPIs matter, let’s look at the specific metrics you can follow that can offer a clear image of your company’s financial performance

1. Net Burn Rate

The rate at which your business is losing money. This tells you how much money you’re spending/losing each month and whether you need to adjust spending or raise more capital.

Cash Outflows – Cash Inflows

2. Runway

How long will your cash last, given the current burn rate? This is critical for understanding how long you can keep your business going before you need more funding or a change in strategy.

Current Cash Balance / Net Burn Rate

3. Net Profit Margin

Your profitability after all expenses are covered. A higher net profit margin means your business is better at converting revenue into actual profit.

(Net Profit / Revenue) x 100

4. Cash Flow

The flow of money in vs. money out. A healthy cash flow is essential for day-to-day operations, ensuring you can cover payroll, suppliers, and other recurring expenses.

Total Cash Inflows – Total Cash Outflows

5. Working Capital

The difference between your current assets and liabilities. Consider it a snapshot of your short-term financial health and your company’s ability to meet its obligations. Positive working capital means you have the liquidity to operate smoothly.

Current Assets – Current Liabilities

6. Revenue Growth Rate

Tracking revenue over time. This is one of the most important metrics for business growth. Steady revenue growth is a positive sign, showing that your business is expanding and attracting more customers (this is just one of the reasons why every company should think about customer satisfaction and keeping them happy).

[(Current Period Revenue – Previous Period Revenue) / Previous Period Revenue] x 100

7. Operating Expenses

Understanding where your money is going. These are costs associated with running your day-to-day business, such as rent, salaries, utilities, etc. Cutting unnecessary operating expenses is one of the most effective ways to increase profitability and improve your bottom line.

Operating Expenses / Revenue

Even though more KPIs exist, these are the core numbers keeping your business grounded. These are practical indicators of how stable, efficient, and profitable your company really is. Whether you’re preparing for growth, trying to cut costs, these are the financial KPIs for small businesses you’ll want to keep an eye on.

Make KPI Tracking Effortless and Measure Your Business's Financial Health

Now that we know more about KPIs and the importance of setting them, let’s talk about how to make tracking your financial performance as easy as possible.

To make financial tracking more efficient and strategic, consider a solution like Compass AI. It’s an interactive finance platform designed specifically for small and medium-sized businesses. Ultimately, Compass AI helps save costs by providing real-time insights into your financial management.

Here’s a brief overview of what you can do inside the Compass app to keep your business finances in check and help them grow: For example:

- Auto-categorize operating expenses

No need for manual tagging or setting rules. The initial categorization is automatic, but it’s possible to adjust it to your own needs. This means no more wasting time manually tracking and identifying every transaction. This way, you can focus on analyzing operating expenses and recognizing areas to cut costs without compromising your company’s growth.

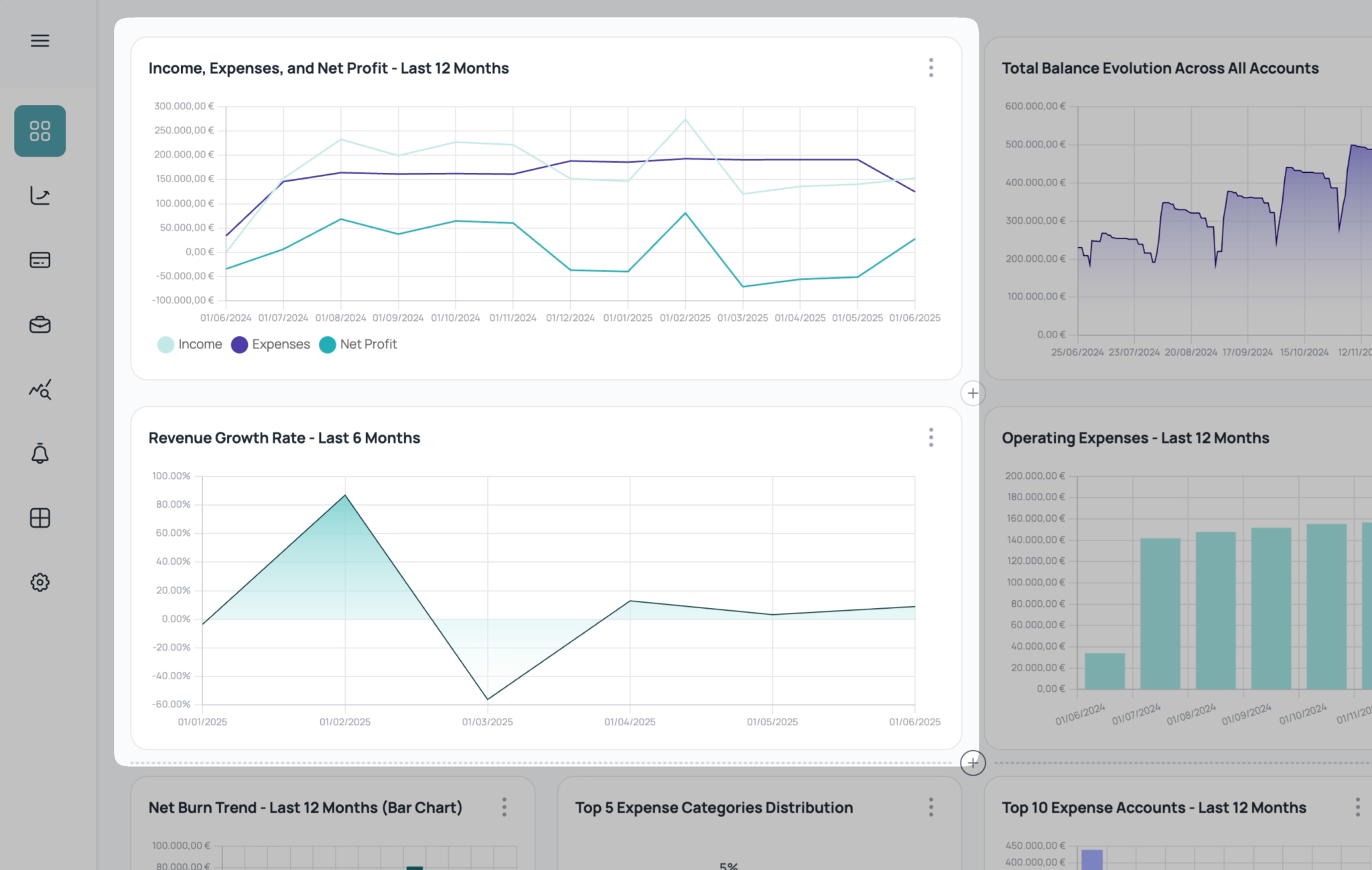

- Visually compare your performance metrics

Visual, real-time overview of each metric. Watch your financial metrics come to life in clear, easy-to-read visuals, for example, a view of your cash flow and net burn rate, to immediately see if your liquidity is at risk and adjust your spending.

- Ask AI how you can reach your KPIs faster

Simply ask questions such as “What is my current burn rate?” or “How has my net profit margin changed over the last quarter?” and get instant answers with visual breakdowns, action plans, or anything else that comes to mind. Get personalized answers and explanations with just a question.

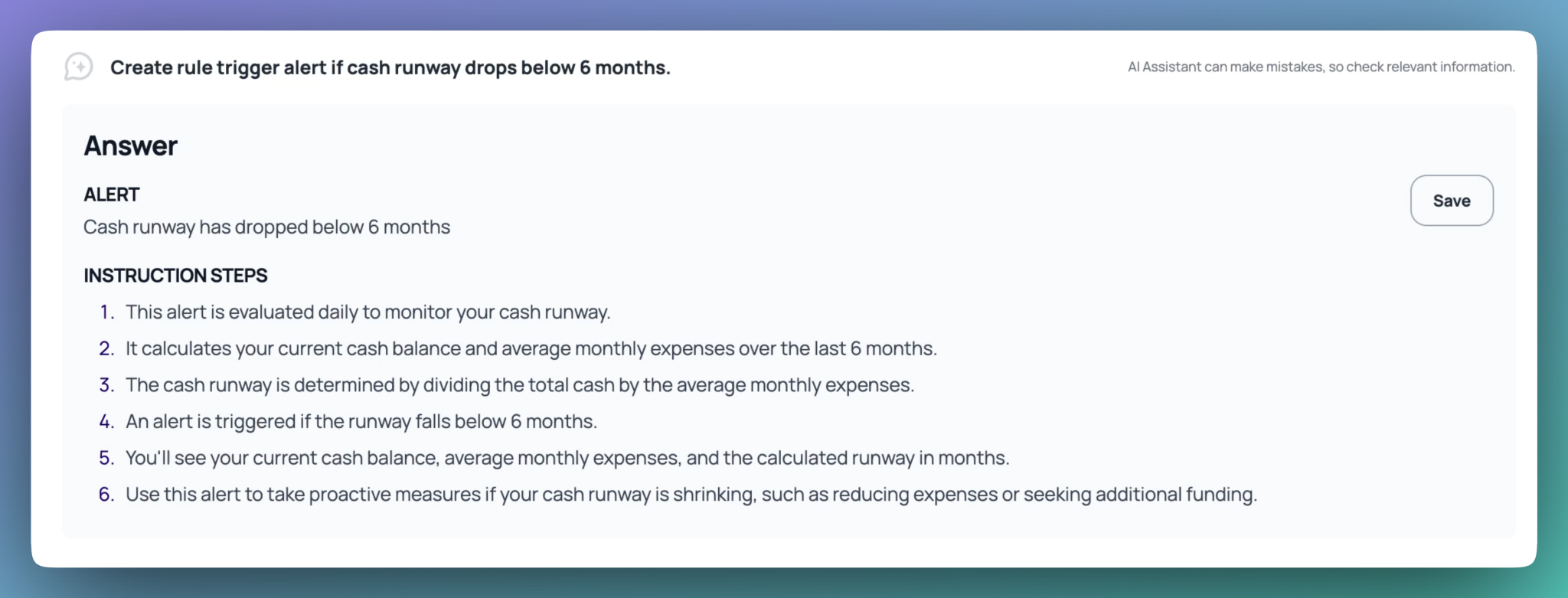

- Track your cash inflow and outflow with the help of alerts

Set alerts for when KPIs cross critical thresholds (for example, a low runway or unexpected operating expenses). Stay on top of your metrics and never miss a critical change in your liquidity or cash flow.

That’s just scratching the surface. Compass isn’t just a tool for tracking numbers, it’s your financial sidekick. No need to juggle between spreadsheets, dashboards, or 2-3 tools that still don’t do it all. It’s very easy to use and built to actually help you understand what’s going on with your money.

Take Control of Your Metrics

Every business owner should stop guessing and start acting based on their real data. Tracking the right KPIs consistently is vital for any leader looking to optimize financial performance, seize growth opportunities, and, in the end, reduce financial risks.

Success comes to those who measure what matters. Make it simple for yourself – try Compass and start tracking your most important KPIs in just a few minutes.