Why Financial Forecasting Is a Gamechanger

Understanding the Power of Predictive Analysis in Financial Planning

Roza Zanini Mozara

July 21, 2025

In business, as in life, it’s important to have a plan. Even more so when working with limited capital, as many companies often do. This is where financial forecasting (estimating future financial outcomes) for small businesses comes into play. It’s a crucial tool for businesses navigating uncertainty, especially SMBs. Think of it as your business’s ability to peek around the corner. Forecasting your financial future helps you not only anticipate challenges and identify risks but also spot opportunities and plan for market changes.

Yet, many small and medium-sized businesses don’t use forecasting to its full potential. While some do manual financial planning with the help of Excel or create overly simplistic projections (like copy-pasting the numbers from previous years), others don’t do it at all.

Let’s dive deeper and see why manual forecasting and overly simplified projections don’t always work, as well as how you can upgrade them.

What is Financial Forecasting?

Financial forecasting is the process of predicting a company’s future financial performance. It’s based on historical data (if available), market trends, and assumptions. Creating a finance forecast helps businesses plan their budgets, hiring, and growth strategies. There are three main types of financial forecasting:

- Short-term forecasting – typically covers the upcoming weeks or one to three months. The main focus is on the day-to-day cash flow forecasting and operational liquidity, ensuring the business meets its immediate operational obligations (think payroll, rent, etc.).

- Medium-term forecasting – usually covers a period of three months up to a year. This kind of financial forecasting is a favorite among CFOs and finance teams. It allows for a more detailed planning of upcoming quarters, budgeting for large purchases, and preparing for seasonal fluctuations. While focusing on medium-term forecasting, companies can create different possible futures: optimistic, realistic, or conservative. And, of course, adjust plans accordingly.

- Long-term forecasting – takes a look beyond a year (typically two to five years into the future), and it can help with strategic planning. From big decisions such as investments to setting growth targets and long-term KPIs. This kind of forecast is important for any business preparing to scale, raise funding, or expand to a new market.

Accurate forecasting (both short and long term) allows businesses to stay agile, make smarter decisions, and avoid any financial surprises.

Common Forecasting Challenges in Small and Medium Businesses

Most businesses begin small. Scrappy, with bad strategic planning and spreadsheet-heavy. Yes, Excel can be a very powerful ally, but relying on it for forecasting without proper models tends to lead to overly optimistic or vague assumptions, so it can turn into simply wishful thinking. It’s not uncommon for businesses to base future expectations on last year’s figures with minor tweaks based on gut feeling. But that's not a reliable strategy or a forecast; that’s a guess. A guess that probably won't do much for their business performance.

Who can blame them! Small businesses often lack access to years of structured data to work with or don’t have the time or tools to regularly analyze what they do have in a meaningful way. Their ability to account for sudden cost changes or revenue drops can sometimes fall short, and can be one of the reasons why certain startups struggle to grow, or some small businesses simply don’t succeed. That, along with bad timing or a flawed business plan, are just some of the reasons why many early-stage companies fail more often than succeed.

Some of the most common challenges in financial forecasting we’ve seen include:

- Lack of historical data – As mentioned above, many small businesses simply don’t have enough reliable long-term data to build meaningful forecasts. Even with some data at their disposal (like financial statements, sales trends, or cost breakdowns), it’s not always easy to extract clear insights without the right tools or experience.

- Limited scenario planning – Especially in the early stages, businesses often focus on a single plan and hope things unfold accordingly. But reality rarely follows just one single path. What happens if costs spike? If sales suddenly slow down (let’s not forget about the various crises in the past)? Or if the budgeting was simply done badly? A single projection simply doesn’t cut it. Creating multiple financial scenarios helps companies stay agile and make informed decisions, even when markets shift and unexpected turns happen.

- Delayed reaction to red flags – Manual tools don’t send alerts. If you have a sudden dip in your revenue, you might not realize it soon enough. And then – it can be too late.

- Static instead of dynamic planning – Markets shift fast. Really fast. And your forecast needs to shift with them. A dynamic, regularly updated forecast is far more effective than a spreadsheet built once a year and then forgotten about.

The truth often hits hard, and the truth is that 38% of small businesses fail due to poor cash flow management, according to the CB Insights startup failure post-mortem report. More times than not, the problem isn’t that the revenue wasn’t there, but the planning and proper financial forecasting weren’t.

How Compass AI Approaches Forecasting Differently

At Compass, we designed the forecasting tool with small and medium business needs in mind. As well as their realities. Our approach is practical, automated, and built for real life.

Here’s how it works and can help your SMB:

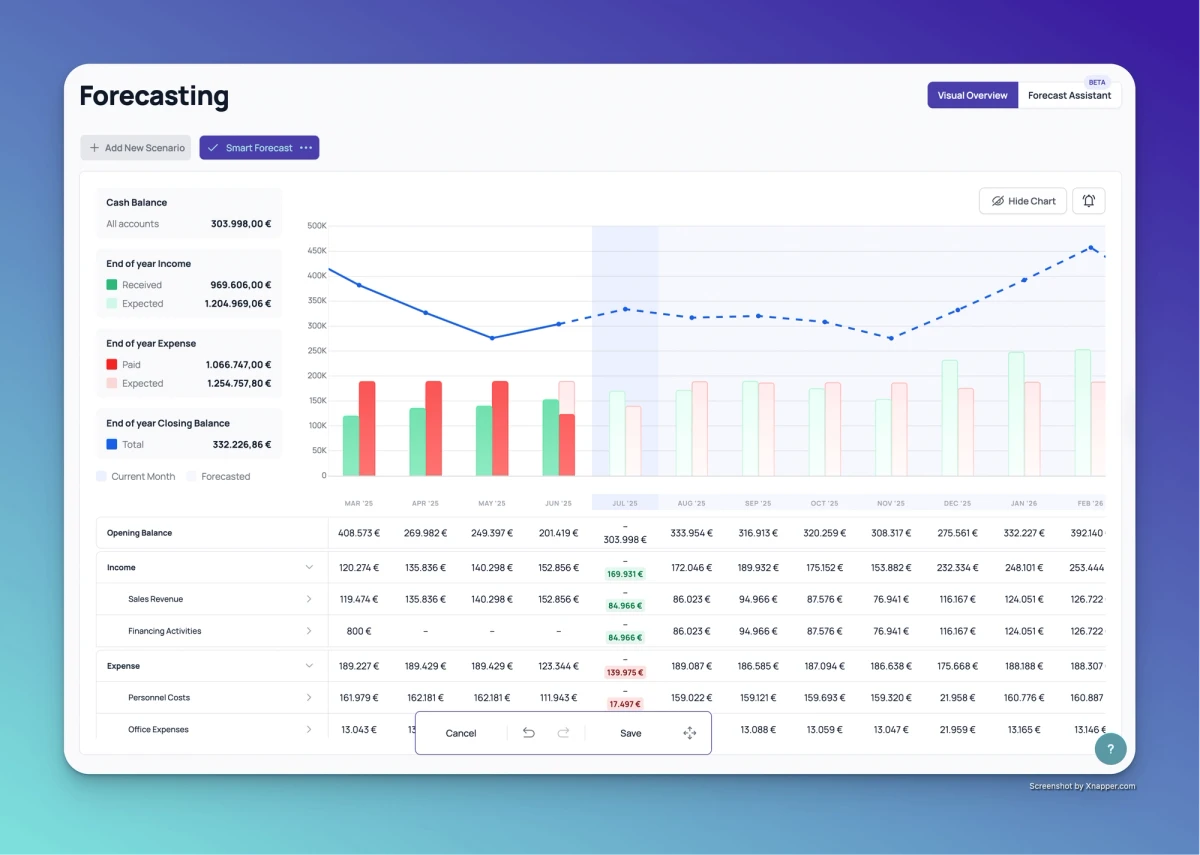

- AI-based Forecasting Model – Compass learns from your past data, uses trends, seasonal patterns, and anomalies. It’s not static, it evolves, as does the prediction it creates.

- 12-Month Projection – Built on intelligent analysis, not static past-year duplication. You get a clear, intelligent view of your upcoming year. We’re saying a big, hard no to copy-pasting.

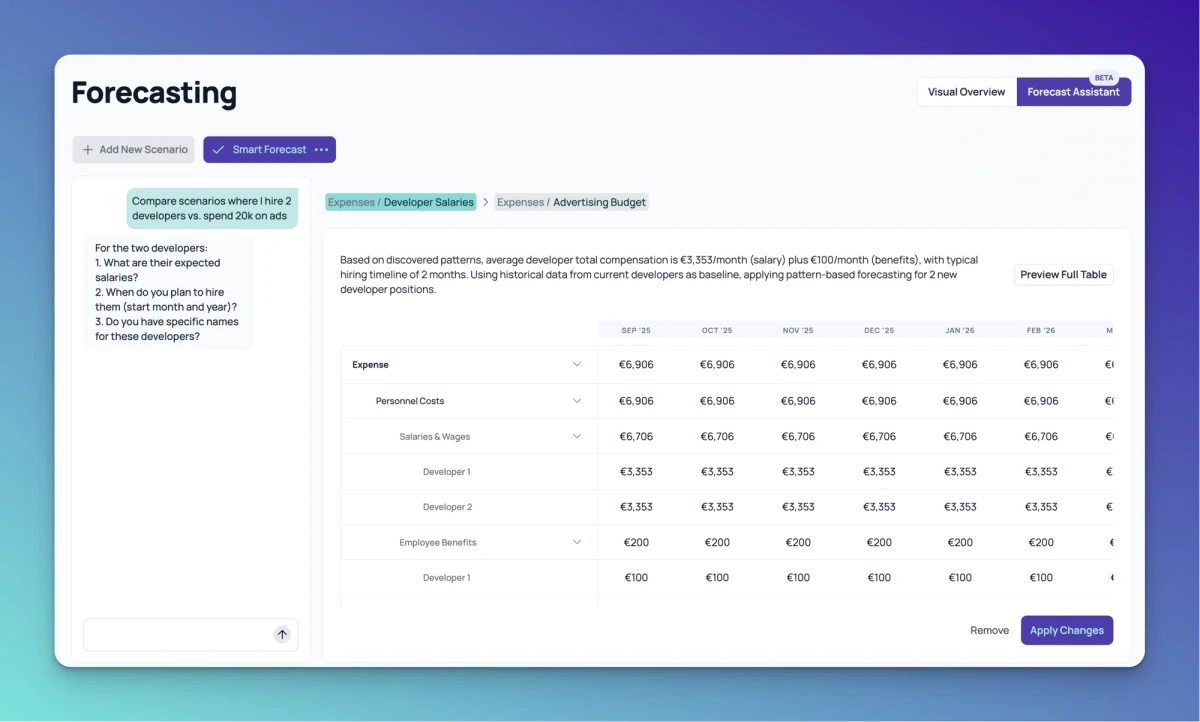

- Scenario Planning – Want to see what will happen if you hire that new person, or if that one client suddenly decides to cut costs? Simply create multiple scenarios – optimistic, realistic, pessimistic – and compare them. Instantly.

- Editable Forecasts – Adjust and update assumptions or expected changes directly in the forecast in just a few clicks. You can even type them up in a conversational manner, and our AI converts the text into numbers.

All that, and you can also use Compass to:

- See your runway and cash flow month-by-month – Know how long your business can operate at current spending levels and what happens if those levels change, to adjust your budgeting appropriately.

- Use our AI Assistant for ‘what-if’ questions – Ask: “What happens to my runway if I reduce expenses by 20%?” or “Can I afford a salary raise in Q3?”. You’ll get answers in seconds.

- Get alerts when actuals deviate from forecast – Create a custom alert, such as “Notify me when my income statement gets lower than the last quarter”. This means no more surprises at the end of the month.

With Compass AI, financial forecasting and planning are not just a once-a-year activity or a spreadsheet lost in a sea of other files. It’s a living, breathing part of your smart business planning. One that’s always accessible, up-to-date, and working in your favor.

Make Smarter Moves with Realistic Planning

When it comes to financial forecasting, it's crucial to understand that it isn’t just something corporations with big finance teams do. It’s an important survival tool for small businesses too (if not more so). Not only that, but it can be a growth engine that helps you scale with confidence.

If your company isn’t doing financial forecasting, or it is, but using Excel or some other spreadsheet tool, reconsider it. Compass gives you access to forecasting in a way that big companies and corporations have been doing it. It’s clear, smart, and designed to help you make the best possible decisions.

Start planning your company’s future, not just surviving the present.